State-administered and Market-driven Loan Rates Adjustment to Change in the Monetary Policy Rates in Nigeria

| Received 25 Jun, 2019 |

Accepted 01 Sep, 2019 |

Published 15 Nov, 2019 |

Background and Objective: Understanding the dynamics of interest rate pass-through is fundamental for the conduction of monetary. The importance of the interest rate in an economy is that the loan rates directly affect the behaviour of households and businesses, which in turn, influences economic growth, inflation, and thus the monetary policy. This paper empirically examined the interest rate pass-through between the central bank policy rate and the commercial bank's loan rates in Nigeria for the pre-liberalization sample (1962-1987) and post-liberalization sample (1987-2018). Materials and Methods: The asymmetric cointegration technique was employed to analyse the data. Results: Results from the threshold cointegration tests between interest rates for the pre-liberalization period exhibits symmetric behaviour. The results also revealed evidence of nonlinear cointegration between the policy rates and retail loan rates in a form of upward rigidity during the post-liberalization period. Conclusion: Results suggested that asymmetric behaviour affects the transmission mechanism of monetary policy, the indicative policy suggested the need for monetary policy-makers to consider such banks behaviour in the future policy formulation.

INTRODUCTION

Interest rate pass-through from Central Bank (CB) to deposit money banks/commercial banks and its macroeconomic implications is a subject that has attracted much attention in recent years. The analysis of the sensitivity of the interest rates set by CB on the behaviour of loan seekers in Nigeria is a topic of great relevance to monetary policy, as interest rate is the leading channel of monetary policy transmission mechanism1. Nigeria began liberalizing its banking sector in late 1986. Before that, the sector has persistently been controlled by the government through the Central Bank2.Then, the CB was authorised to control directly the interest rates3, which however, created some considerable distortions as it prevented the ability of financial institutions to raise loanable funds through saving or money markets4. This effect had resulted in low investment levels and the economy almost comes to a state of stagnation5. This situation is one of the reason that forced the government to adopt the world Banks-IMF structural adjustment programme (SAP) and deregulate interest rate in July 1987 (It should be noted that, though the financial system has been liberalized in 1987, interest rate regulation was re-introduced in 1994 through October 19965. It has also been noted that these controls had negative economic effects, total deregulation of interest rates was again adopted since October 1996). Consequently, the commercial banks were allowed to set their retail rates alongside the objective of fostering competitiveness in the sector6. Liberalization has the potential to expand the market for banking and eases barriers to entry of new participants.

The main instrument used by the Central Bank of Nigeria (CBN) for monetary policy is the official monetary policy rate, also known as the policy rate. This rate will influence loan rates and other macroeconomic variables, such as the exchange rate, money, and credit, price level as well as spending and investment decisions. For example, if the CB wants to control inflation, it alters a short term interest rate, usually the overnight interest rate in the interbank market. The long-term interest rates are then determined by the anticipations of future short term interest rates. For the monetary policy operation to be effective, the response of interest rates to monetary tightening and/or easing should be symmetric. In this sense when the CB changes the official interest rate, it is expected that this change will be entirely reflected in the short-term money market interest rates, which will consequently be passed onto long-term rates. The adjustment process of the commercial bank's lending rates in response to the changes in policy rates, however, may be rigid due to several reasons which include the adjustment cost. Banks will not be willing to charge higher rates when they fear that doing so will make their customers not to fulfill their loan obligations as at when due7. If the interest rate failed to completely pass-through, it could violate monetary policy implementation rule and, thus, the primary goal of macroeconomic stabilization may not be realized8.

The goal of this study is to investigate whether the adjustment of lending rates by commercial banks in response to changes in central bank policy rates is asymmetric, particularly before and after financial sector liberalization. The prominent reason for this study is that historically, especially after the financial sector has been liberalized, Nigeria has been experiencing a highly concentrated banking system in which the six largest banks dominate the domestic banking system, controlling about 60% of the total assets in the industry9.10. The degree of banking concentration has considerable implications for the effectiveness of the monetary policy. The behaviour of large banks can alter the implementation of monetary policy decisions, which can lessen the role and the macroeconomic impact of such decisions. Besides, policy-makers may want to know whether the speed at which loan rates adjust to monetary tightening is different from that of monetary easing under liberalized interest rate regimes.

Currently, little is known about this adjustment process and to what magnitude. Research using a method such as the cointegration and threshold adjustment technique clarified the adjustment process of lending rates to changes in policy rates in Nigeria11. The objective of the present study is therefore to evaluate the pass-through and the adjustment process of Loan rates in response to changes in the central bank's policy rates over the periods of state-administered and market-driven interest rate regimes.

MATERIALS AND METHODS

Study area: The study was carried out at the Department of Economics, Adamawa State University, Mubi, Nigeria from December 2018 - November 2019.

Data sample: Data for the analysis were taken from the online database of the Central Bank of Nigeria, which is only available monthly. The interest rates considered for the analysis are the overnight monetary policy rate (PR) and, the bank's prime lending rate (LR). The data used covers the period 1962 to 1987 (for the pre-liberalization), and 1987-2018 (for the post-liberalization sample). Also, a dummy variable to represent the regulation of interest rates reintroduced between the period 1994 and 1997 is created. The dummy is coded one if the rates were under control and zero otherwise. Another dummy variable to capture the effects of consolidation is also specified. The dummy variable takes on the value of 1 if banking consolidation is implemented, 0 otherwise.

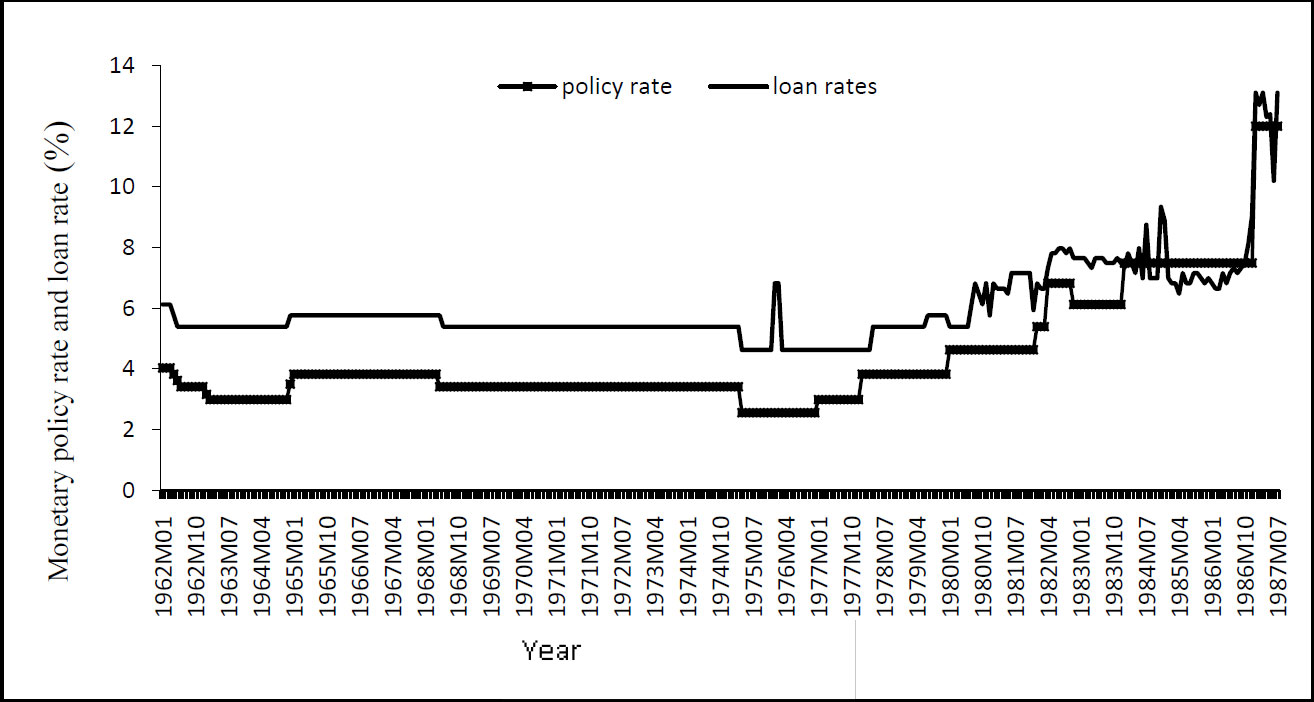

Figure 1 and 2 plot the data before and after the banking sector liberalization respectively. It is apparent from the graphs that, on average, all the series seem to move together. Nonetheless, the time series properties associated with the variables are further examined through stationarity and cointegration tests.

|

Fig 1: Central Banks monetary policy rate and Commercial bank's Loan rates (January 1962 - July 1987) |

|

Fig 2: Central Bank's monetary policy rate and Commercial bank's Loan rates (August 1987 - October 2018) |

Empirical Model Specifications

Empirical models: The pass-through of policy rates to lending rates can be analysed using the Engle and Granger12 approach by estimating a bivariate long-run relationship of the form13;

| $$ B l r_{t}=\gamma_{0}+\gamma_{1} C B p r_{t}+\varepsilon_{t} $$ | (1) |

where, Blr is the price set by banks, that is the bank lending rate, γo is a constant mark-up and CBpr is the marginal cost price (the policy rate) proxied by the market interest rates and, γ1 is the slope coefficient that explains the relationship between the policy rates and the retail rates. εt is the stochastic disturbance term. The coefficient γ1 depends on the elasticity of demand for loans. If the demand for loans is not completely elastic, parameter γ1 is anticipated to be less than one. Demand for loans depends, among other factors, on whether loan seekers have access to alternative sources of funds. The parameter γ1 will also be less than one if banks have some degree of market power.

Statistical analysis: This study takes a different analytical technique in interpreting the long-run relationship in a cointegration framework of threshold adjustment between loan rate and policy rate changes in Nigeria. Before estimation the long-run relationship between the study variables, there is a need to determine their integration order using Augmented Dickey-Fuller (ADF)14 and the Phillips-Perron (PP) unit root tests15. The null hypothesis under both the ADF and PP tests is that the observed variable has a unit root. If the series appeared to be integrated of order one, the study proceeds to examine the long-run relationship between the variables.

After estimating the long run relationship between policy rates and the loan rates, the estimated residual, {  } sequence should be the stationary process. Consider the OLS estimate of ρ9.

} sequence should be the stationary process. Consider the OLS estimate of ρ9.

| $$ \Delta \hat{\varepsilon}_{t}=\rho \hat{\varepsilon}_{t-1}+\sum_{i=1}^{p} \lambda_{i} \Delta \hat{\varepsilon}_{t-j}+v_{t} $$ | (2) |

where, vt is assumed to be independently and identically distributed with zero mean and a constant variance. If the null hypothesis ρ = 0 is rejected, residuals sequence,  isstationary. As such, long-run relationships exist between the policy rate and the lending rate variables. Nonetheless, cointegration between these variables can only be considered properly specified if the adjustment process demonstrates symmetric behaviour. Equation 2

suggests that change in the residual sequence,

isstationary. As such, long-run relationships exist between the policy rate and the lending rate variables. Nonetheless, cointegration between these variables can only be considered properly specified if the adjustment process demonstrates symmetric behaviour. Equation 2

suggests that change in the residual sequence,  is ρ

is ρ  is irrespective of whether

is irrespective of whether  is positive or negative. However, if the adjustment to any deviation from equilibrium is asymmetric, Eq. 2

is not correctly specified. Consequently, Enders and Siklos11 proposed an alternative specification, which is an extended version of Engle and Granger12 cointegration test in the form of threshold autoregression (TAR) model based on Tong16. If the adjustment exhibits more persistent in one direction than the other, it can then be examined by momentum threshold autoregression (M-TAR) in case the errors Eq. 2

may be serially correlated, this model involves incorporation of heaviside indicator function that partitions lagged sequence of residuals generated from the long-run relationship between policy rates and lending rates as follows:

is positive or negative. However, if the adjustment to any deviation from equilibrium is asymmetric, Eq. 2

is not correctly specified. Consequently, Enders and Siklos11 proposed an alternative specification, which is an extended version of Engle and Granger12 cointegration test in the form of threshold autoregression (TAR) model based on Tong16. If the adjustment exhibits more persistent in one direction than the other, it can then be examined by momentum threshold autoregression (M-TAR) in case the errors Eq. 2

may be serially correlated, this model involves incorporation of heaviside indicator function that partitions lagged sequence of residuals generated from the long-run relationship between policy rates and lending rates as follows:

| $$ \Delta \hat{\varepsilon}_{t}=I_{t} \rho_{1} \hat{\varepsilon}_{t-1}+\left(1-I_{t}\right) \rho_{2} \hat{\varepsilon}_{t-1}+\sum_{i=1}^{p-1} \lambda_{i} \Delta \hat{\varepsilon}_{t-i}+v_{t} $$ | (3) |

where, vt∼ I.I.D(0, σ2) and the lagged values of Δ are expected to produce uncorrelated residuals. It is the Heaviside indicator function associated with the TAR and M-TAR, which are specified as Eq. 4 and 5, respectively.

are expected to produce uncorrelated residuals. It is the Heaviside indicator function associated with the TAR and M-TAR, which are specified as Eq. 4 and 5, respectively.

| $$ I_{t}=\left\{\begin{array}{ll} 1 & \text { if } \hat{\varepsilon}_{t-1} \geq \tau \\ 0 & \text { if } \hat{\varepsilon}_{t-1}<\tau \end{array}\right. $$ | (4) |

| $$ I_{t}=\left\{\begin{array}{ll} 1 & \text { if } \Delta \hat{\varepsilon}_{t-1} \geq \tau \\ 0 & \text { if } \Delta \hat{\varepsilon}_{t-1}<\tau \end{array}\right. $$ | (5) |

where, is the value of the threshold.

The stationarity of the sequence , (or Δ

(or Δ ) is satisfied when −2<(ρ1, ρ2)<0, and the threshold value is endogenously determined using Chan's method17. This method arranges the values of the TAR and M-TAR models in an ascending order and removes the largest and smallest 15%. If the deviation Δ

) is satisfied when −2<(ρ1, ρ2)<0, and the threshold value is endogenously determined using Chan's method17. This method arranges the values of the TAR and M-TAR models in an ascending order and removes the largest and smallest 15%. If the deviation Δ is above the threshold, the adjustment is represented by ρ1

is above the threshold, the adjustment is represented by ρ1 (or ρ1Δ

(or ρ1Δ ), while the adjustment for the deviation of

), while the adjustment for the deviation of  below threshold is denoted by ρ2

below threshold is denoted by ρ2 (if the speed of adjustment is at level) or ρ2Δ

(if the speed of adjustment is at level) or ρ2Δ . In the case that the adjustment reveals more persistence or momentum (i.e. if it depend on the change in

. In the case that the adjustment reveals more persistence or momentum (i.e. if it depend on the change in  ). These adjustments are represented by dummy values: the indicator, It will take the value of 1 if

). These adjustments are represented by dummy values: the indicator, It will take the value of 1 if  / Δ

/ Δ ≥ τ , instead, if

≥ τ , instead, if  / Δ

/ Δ <τ, It will take the value of 0. Whether positive and negative departures have different effects on the behavior of policy rates–retail rates nexus could be determined by the estimated values of ρ1 and ρ2. For instance, if |ρ2|<|ρ2| , the adjustment is slow for deviation above threshold value.

<τ, It will take the value of 0. Whether positive and negative departures have different effects on the behavior of policy rates–retail rates nexus could be determined by the estimated values of ρ1 and ρ2. For instance, if |ρ2|<|ρ2| , the adjustment is slow for deviation above threshold value.

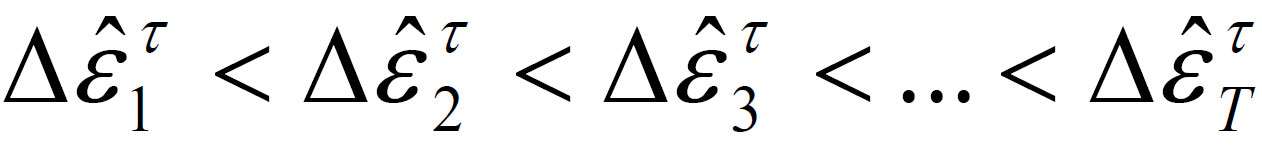

It is assumed in the present analysis that the magnitude of the threshold, is unknown. However, with M-TAR, a super consistent estimate of the threshold can be obtained by ordering the estimated residual sequence in ascending order such that  where T represents the number of usable observations. searching over all values of the lagged residuals sequence17. The estimated threshold with the lowest sum of squares errors (SSE) is the consistent estimate.

where T represents the number of usable observations. searching over all values of the lagged residuals sequence17. The estimated threshold with the lowest sum of squares errors (SSE) is the consistent estimate.

The null hypothesis of no cointegration for both TAR and M-TAR models can be denoted as ρ1 = ρ2 = 0. The F-statistics to examine this null has a nonstandard distribution with certain critical values in Enders and Siklos11. Rejection of the null hypothesis implies that either ρ1 or ρ2 is at least significantly greater than zero. This then allows the test for the presence of linear adjustment processes. This can be done by setting the null hypothesis as ρ1 = ρ2, which can be tested using the standard F-test (or Fisher test) statistic. However, if this null is rejected, one can conclude that the cointegration relationship between the study variables is nonlinear and the adjustment is asymmetric.

RESULTS AND DISCUSSION

The results of the augmented Dickey-Fuller and Phillips-Perron unit root tests of individual time series are reported in Table 1. Data shows that the results for both ADF and PP tests fail to reject the null hypothesis at levels for both the pre and post-liberalization. However, each of the differenced series individually passes the stationarity tests at 1% significance level. The PP test considers the less restrictive nature of the error process and is non parametric unit root tests, modified so that serial correlation does not affect the asymptotic distribution of the observed sample. The PP test results show that all variables are integrated of order one. The test results also reveal that each series is a first differenced stationary at one percent significance level. Consequently, the long-run relationship between the policy rates and lending rates were examined using the dynamic ordinary least square (DOLS). The estimated results are presented in Table 2.

| Table 1: Results of the ADF and PP unit root tests | ||||

| Pre- liberalization: 1962-1987 | Post-liberalization: 1987-2018 | |||

| Variables | ADF test | PP test | ADF test | PP test |

| LRt | -2.107 | -3.179 | -.2193 | 0.0961 |

| ΔLRt | -14.502*** | -24.426*** | -7.264*** | -20.097*** |

| PRt | -1.502 | -1.578 | -2.919 | -2.763 |

| ΔPRt | -16.631*** | -16.670*** | -19.061*** | -19.106*** |

| LR: lending/loan rates and PR: Policy rates. t: Time. ADF: augmented Dickey-Fuller and, PP indicates Phillips-Perron Lag lengths are determined by AIC. *** denotes a rejection of the null hypothesis at the 1% significance level | ||||

| Table 2: DOLS estimation of long-run relationship | ||

| Pre- liberalization: 1962-1987 | Post-liberalization: 1987-2018 | |

| Panel A: Long-run elasticities | Coefficients | Coefficients |

| Constant | 1.075 (0.0000) | 2.725 (0.0000) |

| Lending rates | 0.4961 (0.0000) | 0.1342 (0.0001) |

| REGDUM | 0.0094 (0.6472) | |

| CONSDUM | -0.1651 (0.0000) | |

| R2 | 0.83 | 0.70 |

| Panel D: Diagnostic tests | Test statistic | Test statistic |

| Hansen stability tests (LC) | 0.0144 (>.2000) | 0.0107 (>.2000) |

| JB | 296.747 (0.0000) | 2.0917 (0.3514) |

| REGDUM denotes controlled interest rate dummy. CONSDUM symbolises consolidation dummy. The lags are chosen based on Akaike Information Criterion (AIC). JB: Jarque-Bera statistics | ||

It can be observed from Table 2, on the one hand, that the estimated intercepts for both the pre and post liberalization periods, which denote the intermediation margin of bank's loan rate, are 1.07% for the pre-liberalization period and 2.73%, for the post-liberalization period respectively. The estimated slope coefficient(s) that size the degrees of policy rates pass through, on the other hand, are roughly more than 0.50% for the pre-liberalization and, 0.13%, for the post-liberalization period respectively. Since these slope coefficients are less than unity at the conventional significance levels, it is an indication that pass- through from the central bank policy rates to commercial bank's lending rates during both the pre and post-interest rate liberalization periods appears to be incomplete in Nigeria. However, it appeared that the pass-through is stronger during the pre-liberalization period as the policy rate coefficient are significantly larger than during the post-liberalization period.

The estimated results show that the EG test rejects the null hypothesis of no cointegration at more than 5% significance level for both the pre-and post-liberalization periods, suggesting the existence of a long-run relationship between the policy rates and the loan rates during the study periods in Nigeria. As can also be observed from Table 3, both the TAR and MTAR tests also reject the null hypothesis of no cointegration during the two periods. Interestingly, the results indicate that the null hypothesis of symmetric adjustment ρ1 = ρ2 could not be rejected using both TAR and M-TAR during the pre-liberalization and, TAR both the pre-and post-liberalization periods. But, using MTAR during the post-liberalization period, significance evidence for cointegration between the policy rates and the loan rates was established when asymmetric adjustment is allowed based on the simulated F-test, which critical value is approximately 8.545. This evidence of asymmetry clearly supports the hypothesis that the adjustment of loan rate to any change in the marginal cost of funds-the policy rate is not linear or symmetric as already reported by previous studies13,18,19.

One can note from the table that, the point estimates for ρ1 and ρ2 of M-TAR model during the post-liberalization period are both negative, thus fulfilling the condition for convergence and stationarity. In particular, the point estimates suggest that the speed of adjustment is relatively sluggish for an increase in the policy rate and relatively faster for a decrease in policy rate relative to loan rates, suggesting upward rigidity of loan rates. This result corroborates the findings of Scholnick7 for Singapore, Payne and Waters13 for the US. This finding also provides evidence in support of the customer reaction hypothesis. The result may suggest further that since banks are aware that the central bank is frequently active in protecting consumers from possible abuse and exploitation of financial service providers, they may not want to face the consequences of violating such.

Table 3: Tests for symmetric and Asymmetric cointegration |

|||

| Variables | EG | TAR | M-TAR |

| Panel A: Pre-liberalization period | |||

| ρ | -3.269506 | ` | |

| ρ1 | -0.2535 (0.0609) | -0.2157 (0.0495) | |

| ρ2 | -0.1732 (0.0588) | -0.2000 (0.0818) | |

| Symmetric tests (L) | 12.179** | 11.6745** | |

| Asymmetric tests (NL) | 0.9664 | 0.0291 | |

| Threshold (τ) | -0.0544 | 0.0000 | |

| Panel A: Pre-liberalization period | |||

| ρ | -5.676393 | ||

| ρ1 | -0.1070 (0.0266) | -0.2157 (0.0495) | |

| ρ2 | -0.0634 (0.0320) | -0.2000 (0.0818) | |

| Symmetric tests (L) | 9.480** | 15.200** | |

| Asymmetric tests (NL) | 1.189 | 12.087** | |

| Threshold (τ) | 0.1142 | 0.0226 | |

"ρ" Entries is t-statistic for EG cointegration tests. Entries of "ρ1 and ρ2" represent the coefficients that signify positive and negative deviations from the long-run equilibrium for the both the TAR and MTAR cointegration, respectively. "L" Entries represent the F-statistics that follows a non-standard distribution of the sample values for the null hypothesis ρ1 = ρ2 = 0, and "NL" Entries represent the F-statistics for the null hypothesis of symmetric adjustment ρ1 = ρ2. The appropriate lags for the TAR and MTAR adjustment processes were chosen by AIC. The numbers in parenthesis are standard errors. |

|||

CONCLUSION

Results from the empirical analysis in this study show that there is no complete pass through during both the pre and post-interest rate liberalization periods perhaps due to the presence of market imperfections in the banking sector. The results also show that during the pre-liberalization period, the lending rate seems to adjust symmetrically in the long run. However, during the post-liberalization period, the finding demonstrates that the response of the loan rate to an increase in the official policy rate is slower than its response to a fall in the policy rate. The indicative policy implication is that monetary policy-makers need to consider such banks behaviour in future policy formulation.

Finally, since the central bank's policy rate is not only meant to influence the loan rates but also to deposit rates, future research should focus on comparing the responses of the two retail rates to changes in the policy rates. Modelling asymmetric error correction of the policy retail rate nexus will also uncover some dynamic information vital for monetary policy deliberation in the country.

SIGNIFICANCE STATEMENT

One of the basic propositions of the theory of monetary policy is that the response of retail rates (including loan rates) to monetary policy or official rate changes is symmetric or linear. However, taking the case of Nigeria that experiences both Market-driven and state-administered interest rates, the adjustment process may not necessarily be uniform during both scenarios. This study, using threshold cointegration and asymmetric error correction models provide evidence that justified this claim. The study discovered that, unlike during the pre-liberalization period, the bank's loan rates adjust asymmetrically to changes in the Central Bank's monetary policy rates. Such asymmetric adjustment could affect the speed of the monetary policy transmission mechanism. This finding will help the researchers to uncover the critical areas of monetary formulation and implementation that many researchers were not able to explore. Thus a new theory on the monetary policy transmission mechanism may be arrived at.

REFERENCES

- CBN., 2017. Education in economic series No. 3. Central Bank of Nigeria, Garki Abuja, Nigeria.

- Bulus, Y.D., 2010. The Nigeria inter-bank and monetary policy rates nexus: Any discernable long-run relationship? Econ. Fin. Rev., 48: 1-34.

- Okpara, G.C., 2010. The effect of financial liberalization on selected macroeconomic variables: Lesson from Nigeria. Int. J. Applied Econ. Fin., 40: 53-61.

- Ojo, M.O., 1993. A review and appraisal of Nigerias experience with financial sector reform. Occasional Paper No. 8, Central Bank of Nigeria, Abuja.

- Asogwa, R.C., 2005. Liberalization, consolidation and market structure in Nigerian banking. Afr. Rev. Money Fin. Bank., 2005: 99-127.

- Tella, S.A. and G. Okosun, 1993. Banking deregulation: The interest rate phenomenon in the Nigerian context. Afr. Rev. Money Fin. Bank., 1: 47-56.

- Scholnick, B., 1996. Asymmetric adjustment of commercial bank interest rates: Evidence from Malaysia and Singapore. J. Int. Money Fin., 15: 485-496.

- Marotta, G., 2009. Structural breaks in the lending interest rate pass-through and the euro. Econ. Model., 26: 191-205.

- Soludo, C.C., 2004. Consolidating the Nigerian banking industry to meet the Development challenges of the 21st century.

- Ernst and Young, 2015. Sub-saharan Africa banking review. June 19, 2015.

- Enders, W. and P.L. Siklos, 2001. Cointegration and threshold adjustment. J. Bus. Econ. Stat., 19: 166-176.

- Engle, R.F. and C.W.J. Granger, 1987. Co-integration and error correction: Representation, estimation and testing. Econometrica, 55: 251-276.

- Payne, J.E. and G.A. Waters, 2008. Interest rate pass through and asymmetric adjustment: Evidence from the federal funds rate operating target period. Applied Econ., 40: 1355-1362.

- Dickey, D.A. and W.A. Fuller, 1979. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc., 74: 427-431.

- Phillips, P.C.B. and P. Perron, 1988. Testing for a unit root in time series regression. Biometrika, 75: 335-346.

- Tong, H., 1990. Nonlinear Time-Series: A Dynamical System Approach. Clarendon Press, Wotton-under-Edge, England.

- Chan, K.S., 1993. Consistency and limiting distribution of the least squares estimator of a threshold autoregressive model. Ann. Stat., 21: 520-533.

- Lim, G.C., 2001. Bank interest rate adjustments: Are they asymmetric? Econ. Rec., 77: 135-147.

- Chong, B.S., M.H. Liu and K. Shrestha, 2006. Monetary transmission via the administered interest rates channel. J. Bank. Fin., 30: 1467-1484.

How to Cite this paper?

APA-7 Style

Jibrilla,

A.A. (2019). State-administered and Market-driven Loan Rates Adjustment to Change in the Monetary Policy Rates in Nigeria. Asian Journal of Emerging Research, 1(3), 123-131. https://doi.org/10.3923/AJERPK.2019.123.131

ACS Style

Jibrilla,

A.A. State-administered and Market-driven Loan Rates Adjustment to Change in the Monetary Policy Rates in Nigeria. Asian J. Emerg. Res 2019, 1, 123-131. https://doi.org/10.3923/AJERPK.2019.123.131

AMA Style

Jibrilla

AA. State-administered and Market-driven Loan Rates Adjustment to Change in the Monetary Policy Rates in Nigeria. Asian Journal of Emerging Research. 2019; 1(3): 123-131. https://doi.org/10.3923/AJERPK.2019.123.131

Chicago/Turabian Style

Jibrilla, Aliyu, Alhaji.

2019. "State-administered and Market-driven Loan Rates Adjustment to Change in the Monetary Policy Rates in Nigeria" Asian Journal of Emerging Research 1, no. 3: 123-131. https://doi.org/10.3923/AJERPK.2019.123.131

This work is licensed under a Creative Commons Attribution 4.0 International License.